The Dynamic Support and Resistance indicator is unique, and to utilise it’s full potential, will probably require you to ‘rethink’ your whole approach to how you view and interpret support and resistance in the future. This is not to say that the underlying concept of support and resistance has changed with this indicator – it hasn’t. The old rules still apply where we are looking for areas of price congestion, which then define potential platforms of either support and resistance, which then either hold firm or are breached.

The game changer with this indicator, is not just how these levels are calculated and then displayed, but the accuracy of these signals. Most support and resistance indicators on the market today, will generally display some broad price range. To us, broad bands are of little use in whatever timeframe you are trading, when actually what you need are those price levels defined for you with pin point accuracy clearly on the screen. As you may have guessed, the Quantum Dynamic Support & Resistance indicator does not draw or display bands. It produces pinpoint levels to the nearest pip!

The second, and perhaps even more crucial point, is that as a trader, you need to have some gauge as to the strength or weakness of such price areas. After all, if the market is approaching an area which is considered strong, then the more likely the level will hold. This is another key aspect of the indicator – whilst it produces single lines to show areas of support and resistance, these signals are then given further power as the lines cluster together to signal stronger regions. Where one, two or perhaps three lines cluster, then this can be considered and extremely strong area of price support or resistance. In other words, clusters of lines add huge weight to these regions, which you can see for yourself, simply and easily. Now you have an indicator which not only displays these regions accurately, but then gives you that crucial information, the strength of these regions. Clusters hold the key, and wherever you see these displayed, you can be assured that the market will take effort to breach them.

Finally, and lastly, the indicator works dynamically, building these levels as the price action unfolds in realtime. This perhaps is the area that you will have to ‘rethink’ when using this indicator. Whilst the indicator is using historic price levels to gauge future price regions, it is also constantly scanning the current price action, to deliver support and resistance levels, IN THAT AREA, since this is the region of most interest to you as a trader. In other words, the support and resistance levels generated will coincide with the CURRENT price action. From there it is a simple case of then moving up and down the timeframes, to see where the longer term or shorter term support and resistance regions are on those charts, as well as searching for clusters.

It’s an immensely powerful indicator which maps out the direction of price at any given moment. For most traders, the profit that springs from trading, comes from determining support and resistance levels precisely. With this indicator, you can tell EXACTLY where and when price is moving up or down, thus giving you the ability to gauge:

- Optimum entry levels

- Safe exit levels

- Proper stop loss levels

- Excellent take profit levels

But as with all Quantum Trading indicators, there’s more, a great deal more!

The indicator makes no distinction between support and resistance. A certain price level that acts as support now can eventually be a resistance in the next session. Each line influences the movement of price for the entire chart;

- It is incredibly accurate – almost like magic

- The indicator is dynamic, which means the support and resistance lines generated coincide with the current price action

- Coupled with the Quantum Dynamic Price Pivots indicator, the Quantum Dynamic Support & Resistance indicator becomes even more powerful

In summary. This is a very different approach to the concept of support and resistance and one which may take you a short time to grasp. The key difference is that using this indicator, you will need to trade using multiple timeframes to maximise its power which will then reveal future levels for you further from the current price action, and the key points to bear in mind are as follows:

- The indicator displays two types of support and resistance lines giving you precision in your trading decisions:

- Dotted lines are levels in the chart where price has tested at least once within the Look Back period.

- Solid lines are levels in the chart where price has tested more than once within the LookBack period and can be perceived as a stronger indicator of support or resistance.

- Look for clusters of lines on the indicator. Where these appear then you can be sure this is a strong level of support or resistance

- Use multiple timeframes to see levels of support and resistance further from the current price action. Remember, the indicator is generating these levels to coincide with the CURRENT price action (where this information is most useful!!!)

Finally, the indicator is entirely configurable for two reasons. First, all currency pairs have different trading characteristics and price chart profiles, and to reflect this, the indicator can be tailored to show a greater or lesser number of support and resistance levels. Secondly, this also allows you to tailor the detail to your own trading style. Some traders prefer more detail, other less. All of this is available for you to configure and explained below.

- The Quantum Dynamic Support & Resistance indicator works in all timeframes

- The default setting for the indicator is 100 BarsAgo (see below) which we have found is perfect for M1 to H1. For timeframes above H1, you will need to double this figure, and then double again for long term charts. This is explained below.

Applying the Indicator

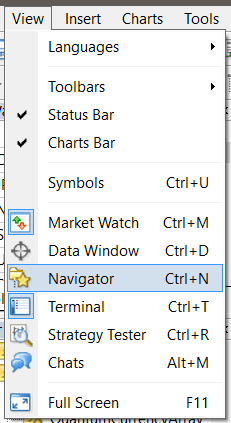

Open your MT4 platform and in the main menu, select View > Navigator to open the Navigator window which appears at the left hand side of your workspace.

In the Navigator window, expand the Indicators tree by clicking the “+” symbol. Find the Quantum tree and expand it by clicking the “+” once again to reveal the full list of Quantum Trading indicators.

To start using the indicator, you can click and drag QuantumDynamicSupportAndResistance from the Navigator to a chart or you can also double-click QuantumDynamicSupportAndResistance (which will then be applied to the currently selected chart). Doing either one of these will display the Custom Indicator window where you can configure all the various user settings for your Quantum Dynamic Support and Resistance. These options are grouped and can be accessed by selecting the tabs which will be discussed further in the following sections. Once you are done customizing the indicator’s options, click OK to run the indicator.

About tab

Here you will find basic information about the indicator such as its name, description, and version number.

Common tab

Please make sure that the “Allow DLL imports” option is checked/ticked before running the indicator. This is required by all Quantum indicators to properly communicate with its accompanying DLL file. Alternatively, you can set this option globally by selecting in the main menu, Tools > Options > Expert Advisors tab and checking/ticking the “Allow DLL imports” option. Other than this, please leave other options to their default setting.

Inputs tab

You can configure the indicator by changing its variables listed in this tab. We explain each configurable input of the Quantum Dynamic Support and Resistance below.

Dependencies tab

All the files that the indicator uses to run is listed here. You can leave this tab as it is.

Colors tab

The Quantum Dynamic Support and Resistance uses drawing objects instead of plot lines so this tab is empty.

Visualization tab

The indicator’s visibility can be toggled on or off in different contexts with the options in this tab.

Configuring the Indicator

Let’s return to the Inputs tab and explain how to customize the settings of your Quantum Dynamic Support and Resistance indicator.

Account Email

When running the Quantum Dynamic Support and Resistance for the first time in your trading account, you need to enter the email you used to register in the Quantum Trading Indicators Enablement System – http://enable.quantumtrading.com/ as part of its verification process. You only need to do this once as the email is stored in the terminal’s global variable cache after it is entered initially. Please make sure that you enter your email correctly and exactly without any extra spaces before and after it. If you made an error, simply fill this field again to update it.

Look Back

This setting defines the number of bars the indicator processes starting from the most current bar. All support and resistance lines are generated within this period.

Line Color

You can change the value of this setting to customize the color of the support and resistance lines that the indicator generates. Its default color is darkgoldenrod.

Removing the Indicator from the Chart

Open the chart’s Indicator List window by pressing Ctrl+I. You can also right-click the chart and select Indicator List from the context menu.

Select QuantumSupportAndResistance and click the Delete button then click the Close button.